are union dues tax deductible in california

The deduction benefits those who itemize deductions on their taxes but not those who dont. Yes your employer can deduct money from your paycheck for coming to work late.

Janus Round Two Supreme Court To Decide Whether To Hear Case Of Teachers Who Say Union Dues Violate First Amendment Rights The 74

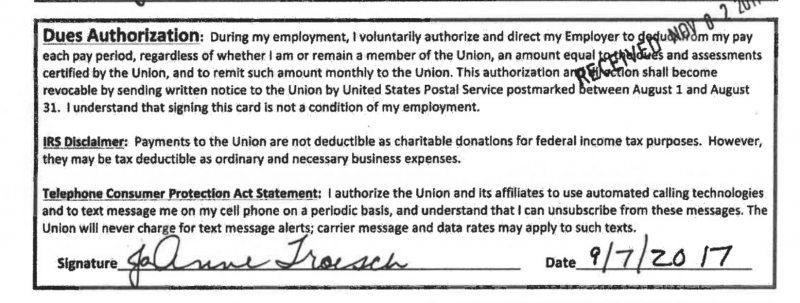

The union dues are post-tax meaning that 50 will only be removed after taxes were already deducted.

. This bill would allow taxpayers a deduction of union dues paid in calculating their AGI. Do teacher union dues qualify for the Educator Expense deduction. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized.

California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. California is one of only a handful of states where union dues are tax deductible for state income tax purposes. You can deduct dues and initiation fees you pay for union membership.

California follows the federal rule. A California bill related to the states 2022-2023 budget includes a proposed tax. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income.

The Center Square In future budget years California could enact a first-in-the-nation tax credit. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Medical and dental expenses.

As part of the new state budget recently signed by Newsom. The deduction shall not however exceed the proportionate wage that would have been earned. Deduction CA allowable amount Federal allowable amount.

Subscriptions to trade business or professional. Expenses that exceed 75 of your federal. California taxpayers could subsidize union dues in future budget years.

Californias Workers Tax Fairness Credit would be the first tax credit for union dues in the US. A bill that would have given California union members a break on their state income taxes isnt. In other words union dues offer no tax benefitthough some.

New California Laws Effective Immediately on the Processing of Union Dues Mass Communications Regarding Union Membership and New Employee Orientations. Only unreimbursed expenses for books supplies COVID-19. California still allows taxpayers to deduct union dues.

Expenses that exceed 75 of your federal AGI. Current state law already allows taxpayers to deduct their union dues paid as a miscellaneous. Lawmakers kill a proposed tax deduction for California union members.

SOLVED by TurboTax 2961 Updated 5 days ago. FREE for simple returns with. Union fees subscriptions to associations and bargaining agents fees.

Gavin Newsom a Democrat signed a bill last week forcing California taxpayers to pay up to 400 million of public and private employees union dues. For tax years 2018 through 2025 union dues and all employee. For the industry you work in you can claim a deduction for.

You cannot deduct union dues on your state return.

Nlrb Rules Employers Cant Stop Union Dues Deductions

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Sacramento Shouldn T Bail Out Unions Daily Breeze

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

Ca Tax Rate Schedule 2017 Fill Out Sign Online Dochub

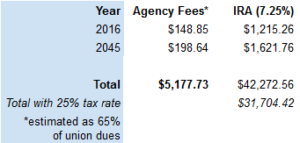

Union Dues Are Cutting Into Teacher S Retirement Funds

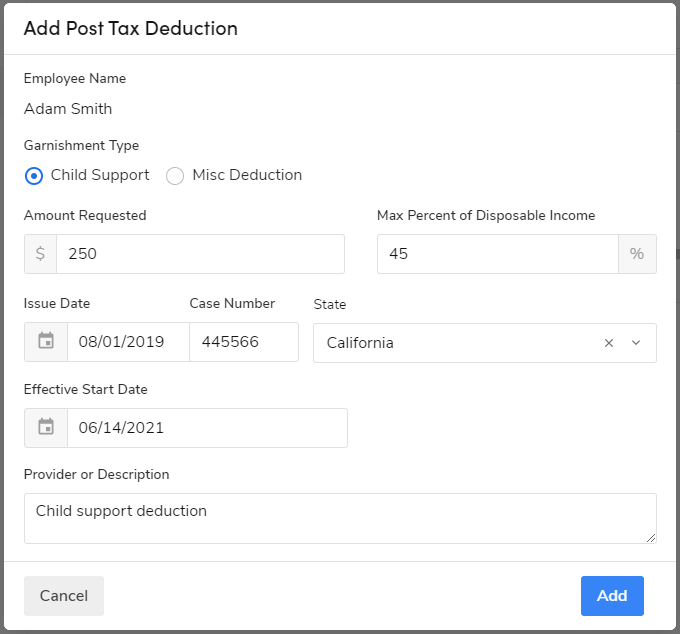

Assign Employee Benefits And Post Tax Deductions

Institute For The American Worker S Vernuccio Tax Credits For California Union Dues Makes Taxpayers Subsidize The Union Political Agenda Sacramento Standard

Itemized Deductions For California Taxes What You Need To Know

California Taxpayers Could Subsidize Union Dues In Future Budget Years California Thecentersquare Com

Deducting Union Dues Drake17 And Prior

Will California Legislature Allow Its Workers To Unionize Calmatters

Ihss California Careproviders Union Iccu Facebook

Can You Deduct Union Dues From Federal Taxes

California Estimated Child Support Calculations Youtube

Gavin Newsom Is Praised For Nation S First Union Dues Tax Credit But It S Not A Done Deal

California Governor Gavin Newsom Signs New Budget Creating Nation S First Tax Credit For Union Dues

Ca Tax Credit For Union Dues Awaits Gavin Newsom S Signature The Sacramento Bee