will capital gains tax rate increase in 2021

While it is possible Congress could make any capital gains tax increase. Basic rate payers and higheradditional rate payers.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

However it was struck down in March 2022.

. By Charlie Bradley 0700 Thu Oct 28 2021. Assume the Federal capital gains tax rate in 2026 becomes 28. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows.

Increase Tax Rate on Capital Gains Current Law. The Chancellor acknowledged the difficulties facing homeowners and businesses after the Bank put up its base rate from 225 per cent to 3 per cent on Thursday the highest for. The basic rate tax threshold is 50270 so if they are a basic rate taxpayer earning 30000 a year 20270 of their capital gain is calculated at 18 per cent with the remaining.

While it is unknown what the final legislation may contain the elimination of a rate. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

If your income was between 0 and 40000. Most realized long-term capital gains. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent.

The dividend tax rates for 202122 tax year are. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Increasing the top capital-gains rate and lowering the income thresholds at which that top rate applies would raise 123 billion over the next decade according to an estimate. Married separately taxable income. The top marginal income tax rate of 37 percent will.

4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. Tax rate for capital gains. Over the 20202021 tax year the basic rate on.

Head of home taxable income. The proposal would increase the maximum stated capital gain rate from 20 to 25. 75 basic 325 higher and 381 additional.

Capital Gains Tax Rate 2021. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Married joint taxable income. This means youll pay 30 in Capital Gains.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. CGT rates differ from income tax rates and are in two broad brackets. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

The effective date for this increase would be September 13 2021. The proposal would be effective for taxable years beginning after December 31 2021. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

The Proposed Changes To Cgt And Inheritance Tax For 2022 2023 Bph

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

What You Need To Know About Capital Gains Tax

September 13 2021 Update Democrats Propose New Tax Increases Srs

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Stocks Retreat On Capital Gains Plan Nationwide Financial

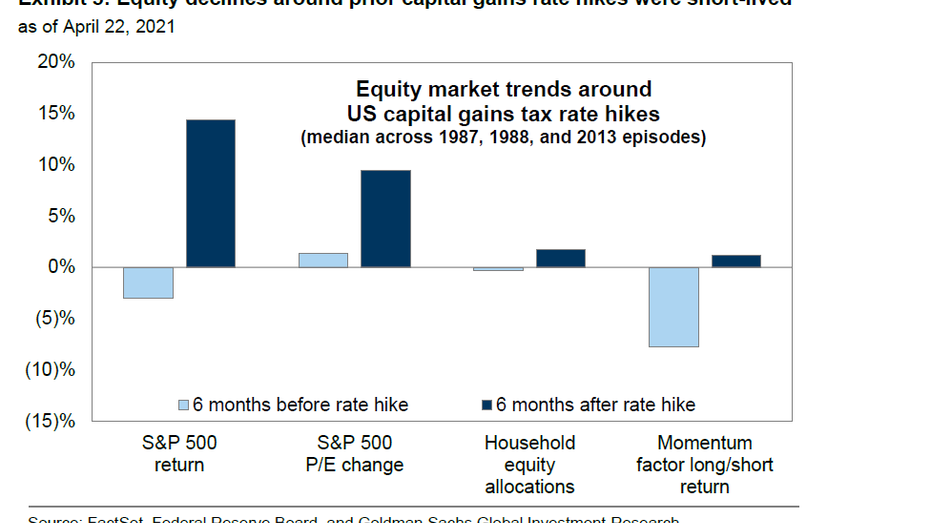

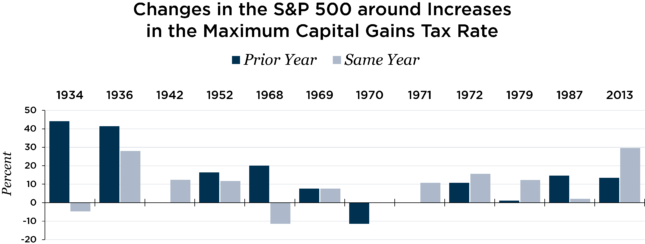

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Tax In The United States Wikipedia

An Overview Of Capital Gains Taxes Tax Foundation

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

2022 Capital Gains Tax Rates Federal And State The Motley Fool

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Business Capital Gains And Dividends Taxes Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Paying The Piper The Impact Of An Increased Capital Gains Tax Rate When Selling Their Business Rocky Mountain Business Advisors